The Current State of Energy Security in Europe

The Current State of Energy Security in Europe

Policy Analysis 10 / 2025 by Josefine Paulsen, Dan Ziebarth, Cengiz Günay & Johannes Späth

Keywords: Energy security, resilience, REPowerEU, infrastructure, renewable energy

EXECUTIVE SUMMARY

This Policy Analysis examines the state of energy security in Europe. The concept of energy security has been commonly used to refer to the ability to securing uninterrupted access to energy and energy supplies at an affordable price (IEA, World Energy Outlook 2022). Energy security is essential for maintaining economic stability, political security, and social well-being. Although, the classic approach energy security is reducing dependencies through the diversification of energy sources and supplies, energy security also requires robust and resilient infrastructure, political and bureaucratic will, market conditions and cooperation. Building for energy security also entails the right assessment of the existing realities. Europe‘s energy security faces multiple threats and risks. This policy analysis identifies four major threat domains to energy security: (1) geopolitical coercion and cyberattacks; (2) infrastructural and systemic weaknesses; (3) resource scarcity and critical mineral dependency; and (4) political/regulatory fragmentation. The paper argues that over-reliance on diversification (e.g., of imports such as replacing Russian gas with Qatari LNG and diversifying the energy mix through an increase in renewable energy) won‘t be enough. The EU also needs to invest in innovative technologies and infrastructure. The blackout in Spain highlighted the vulnerability of grids to high levels of renewable energy without the necessary adaptations. European energy security requites inclusive and integrated resilience strategies with a whole-of-society approach, technological innovation and cooperation, investment in infrastructure, bureaucratic coordination, and political unity.

INSIGHTS

ENERGY SECURITY GOES FAR BEYOND STABLE SUPPLY ROUTES:

Europe’s energy security is not just about gas supplies or price shocks. It hinges on the resilience of complex, interdependent systems to geopolitical coercion, cyberattacks, and infrastructural fragility.

DIVERSIFICATION REQUIRES A HOLISTIC APPROACH:

Despite rapid progress in diversifying energy sources and accelerating renewables, the EU still faces major vulnerabilities, including grid instability, cross-border fragmentation, and dependence on imported strategic materials.

NO RESILIENCE WITHOUT POLITICAL UNITY:

True energy resilience requires not just technical upgrades but political integration. Without deeper alignment across member states, even the most sophisticated energy strategies risk being undermined by fragmentation and uneven implementation.

ZUSAMMENFASSUNG

Die vorliegende Kurzanalyse untersucht den Stand der Energiesicherheit in Europa. Das Konzept der Energiesicherheit bezieht sich auf die Fähigkeit, ununterbrochenen Zugang zu Energie und Energieversorgung zu einem erschwinglichen Preis zu gewährleisten (IEA, World Energy Outlook 2022). Energiesicherheit ist für die Aufrechterhaltung der wirtschaftlichen Stabilität, der politischen Sicherheit und des sozialen Wohlergehens unerlässlich. Obwohl der klassische Ansatz der Energiesicherheit vor allem darauf abzielt Abhängigkeiten durch die Diversifizierung der Energiequellen und -versorgung zu verringern, erfordert Energiesicherheit auch eine robuste und widerstandsfähige Infrastruktur, politischen und bürokratischen Willen, gute Marktbedingungen und Zusammenarbeit. Der Aufbau von Energiesicherheit erfordert auch eine realistische Einschätzung der Gegebenheiten. Die Energieversorgungssicherheit Europas ist vielfältigen Bedrohungen und Risiken ausgesetzt. In dieser Kurzanalyse werden vier Hauptbedrohungsbereiche für die Energiesicherheit identifiziert: (1) geopolitischer Druck und Cyberangriffe; (2) infrastrukturelle und systemische Schwächen; (3) Ressourcenknappheit und die Abhängigkeit von kritischen Mineralien; sowie (4) politische/regulatorische Fragmentierung. Die Analyse argumentiert, dass zu starkes Vertrauen in die Diversifizierung (z. B. von Importen, wie der Ersatz von russischem Gas durch katarisches Flüssiggas und die Diversifizierung des Energiemixes durch einen Anstieg der erneuerbaren Energien) nicht ausreichen wird. Die EU muss auch in innovative Technologien und Infrastrukturen investieren. Der massive Stromausfall in Spanien hat gezeigt, wie anfällig die Netze für einen hohen Anteil an erneuerbaren Energien sind, wenn die notwendigen Anpassungen nicht vorgenommen werden. Die europäische Energiesicherheit erfordert umfassende und integrierte Resilienzstrategien mit einem gesamtgesellschaftlichen Ansatz, technologische Innovation und Zusammenarbeit, Investitionen in die Infrastruktur, bürokratische Koordination und politische Einigkeit.

WESENTLICHE EMPFEHLUNGEN

ENERGIESICHERHEIT GEHT WEIT ÜBER STABILE LIEFERWEGE HINAUS:

Europas Energiesicherheit beschränkt sich nicht nur auf Gaslieferungen oder Preisschwankungen. Sie hängt vielmehr von der Resilienz komplexer, miteinander verflochtener Systeme gegenüber geopolitischem Druck, Cyberangriffen und infrastruktureller Anfälligkeit ab.

DIVERSIFIZIERUNG ERFORDERT EINEN GANZHEITLICHEN ANSATZ:

Trotz schneller Fortschritte bei der Diversifizierung der Energiequellen und dem Ausbau erneuerbarer Energien bestehen in der EU weiterhin erhebliche Verwundbarkeiten – darunter Netzinstabilität, grenzüberschreitende Fragmentierung und die Abhängigkeit von importierten strategischen Materialien.

KEINE RESILIENZ OHNE POLITISCHE EINHEIT:

Wahre Energie-Resilienz erfordert nicht nur technische Modernisierungen, sondern auch politische Integration. Ohne ein tieferes Zusammenwirken der Mitgliedstaaten laufen selbst die ausgeklügeltsten Energiestrategien Gefahr, durch Fragmentierung und ungleiche Umsetzung untergraben zu werden.

Introduction

On 28 April 2025, lights went out across the Iberian Peninsula. A cascading power failure hit Spain and Portugal, plunging approximately 55 million people into darkness (Horton 2025).

It is the largest blackout Europe has experienced in the last two decades (Kemene & Christianson 2025). For around ten hours, daily life was paralyzed; Trains and metros stopped mid-journey, traffic lights failed, mobile networks experienced severe outages, and businesses could not process transactions and payments. Hospitals switched to backup generators to keep life-support systems running. By the time power was finally restored, the human and economic toll was stark. At least eight people lost their lives due to blackout-related incidents (Agencias 2025; Baltarejo 2025).

The CEOE, the Spanish Confederation of Business Organizations, estimated that the blackout cost the economy around €1.6 billion, approximately 0,1% of Spain’s GDP, pointing to longer-lasting effects such as damage on oil industry infrastructure from which it may take weeks to recover (The Corner 2025). There have been speculations about the reason(s) for a power outage of this magnitude. While some experts find explanation in the fact that the Iberian Peninsula is quite isolated from European power grids, others have highlighted that the rather high percentage of solar energy electricity might have been a reason for high oscillations while others have hung on to the idea of a cyber-attack (Gavin et al. 2025).

The blackout in Spain and Portugal occurred in a time of heightened geopolitical tensions, economic crisis and intensive debates on European energy transition. While Russia’s attack on Ukraine in 2022 highlighted the importance of diversification of energy supply, the blackout on the Iberian Peninsula in April 2025 dramatically revealed the vulnerability of infrastructure and the risk of large-scale power outages in electricity systems with high shares of renewable energy (Bajo-Buenestado 2.5.2025).

Russia’s full-scale attack on Ukraine in 2022 has had a profound impact on energy markets. Energy prices skyrocketed, triggering high inflation and economic stagnation across much of the EU. In Spain, a massive power outage brought public life to a standstill: transport, telecommunications, healthcare, businesses, and even military defence systems were disrupted. In response, Spanish authorities declared a national emergency and deployed 30.000 police officers to maintain order (Livingstone et al. 2025).

These two cases underscore the diverse risks and far-reaching consequences of energy disruptions. Rising electricity demand, the accelerating effects of climate change, geopolitical tensions, outdated infrastructure, and insufficient strategic oversight all pose serious challenges to Europe’s energy security.

This Policy Analysis provides an overview of the current state of European energy security. It defines the concept, identifies key risks and threats, and critically examines the strategies developed at the EU level to respond to them.

What is energy security?

The term energy security has been commonly used to refer to the ability to securing uninterrupted access to energy and energy supplies at an affordable price (IEA, World Energy Outlook 2022). It is considered to be crucial for maintaining economic stability, political security, and social well-being (Ibekwe et al. 2024).

The concept encompasses both short-term and long-term aspects, including the capacity to respond quickly to changes in energy supply and demand, as well as investments in sustainable energy resources to support economic development and environmental protection (Cherp et al. 2012). Historically, the concept of energy security emerged in the context of international relations and the interaction of states with one another (Yergin 2006, 69).

The 1973 oil embargo imposed by the Arab Petroleum Exporting Countries on the West in response to its support for Israel during the Yom Kippur War led to widespread energy shortages and a sharp increase in global oil prices, sparking debates on energy independence.

The same year, then US-President Nixon launched the Project Energy Independence which aimed at achieving energy self-sufficiency by 1980 (Yergin 2006, 69). The classic approach to reducing dependency has been the diversification of energy sources and supplies.

However, energy security has meant different things at different times and in different contexts (Grossman 2021). As Yergin (2006, 30) rightly emphasizes exporting countries such as Russia are interested in asserting state control over strategic resources and supply such as pipelines whereas in countries such as China and India energy security has been interpreted as the ability to adjust to dependencies. In Europe the debate has mainly centered around the question of decreasing dependencies from Russian gas through diversification – but diversification strategies have significantly varied from one country to another. While some countries such as France have promoted nuclear power, others have rather pushed for a larger share of renewable energy production.

Therefore, the concept of energy security is complex. It certainly goes much beyond the diversification of energy sources and supplies. Energy security also requires a resilient infrastructure, political and bureaucratic will, market conditions and cooperation. Building for energy security also entails the right assessment of the existing realities. As there is no absolute security, the concept should be rather viewed on a spectrum from secure to insecure. As Grossman (2021, 93) rightly asserts energy security is now a trope—a metaphor and symbol rather than a goal that real policy can achieve. However, it can help address vulnerabilities and increase resilience.

More recently, the concept of energy autarky has been increasingly voiced by security experts. Energy autarky takes the concept of energy independence a step further and suggests relying solely on local energy resources. In most of the cases this would entail renewable energy production such as hydro energy, solar, wind, or geothermal energy. Energy autarky aims to reduce vulnerabilities associated with global energy markets and supply chain disruptions through decoupling (Pieńkowski & Zbaraszewski 2019). Therefore, energy autarky refers to self-sufficiency in energy production and consumption within smaller units such as a specific region, community, or entity (Müller et al. 2011). While the concept of energy autarky suggests resilience to vulnerabilities linked to external factors, it hardly addresses the question of internal systemic vulnerabilities.

In public discourses, energy autarky is often used to promote certain technologies and solutions. While some experts encourage decentralized energy solutions, such as micro-grids, that enable communities to generate and manage their own energy (Mengelkamp et al., 2018). Although decentralized renewable energy production can be particularly beneficial in rural or remote areas where centralized energy infrastructure is limited (Ibrahim et al., 2025), too much decentralized renewable energy production can put national grids under stress.

There has been also a growing trend towards small nuclear power production units; SMRs. SMRs are small, modular prefabricated units that can be shipped and installed on site (IAEA 2023). While nuclear power production has been rather controversial in Europe, the world’s first floating nuclear power plant began commercial operation in May 2020, in Russia. Other SMRs are under construction in Argentina, Canada, China, Russia, South Korea and the United States of America.

Risk and threats to European energy security

Russia’s attack on Ukraine in February 2022 has dramatically illustrated that the EU’s policies building on engagement and economic interdependencies do not necessarily prevent crisis, geopolitical tensions and wars. "Europe’s geopolitical awakening" (Borell 2022), meaning a more strategic, military and security policy-oriented Europe has also entailed a stronger focus on energy security and its geopolitical dimension.

However, energy security also faces other risks such as climate change-related developments, weak infrastructure, the incompatibility of technologies and sources and not least human failure.

Particularly climate change-related developments are occurring with increasing frequency. The heatwaves and droughts in 2022, for example, crippled hydropower output and forced nuclear reactors to reduce output due to limited cooling water, compounding the gas shortage as more fossil generation was required (Zeniewski et al. 2023). In winter, a loss of power could mean the loss of heat, posing a life-threatening risk to vulnerable populations. Simultaneously, information systems reliant on cloud infrastructure or network connectivity may collapse, obstructing both civilian communication and official crisis coordination.

In regions dependent on electric pumps and purification systems, such as Alpine valleys in Austria, a grid outage could quickly compromise water security. Sewage treatments plants may stop functioning properly, leading to environmental contamination and potential public health risks. While most backup generators operate on diesel, gas stations still depend on electricity to power fuel pumps.

While renewable energy sources are an important element of the energy transition plan, there is also a higher risk of large-scale blackouts in electricity systems with high shares of renewable – as was the case on the Iberian Peninsula. Different from synchronous generators as used in conventional power plants such as hydroelectric, thermal and nuclear, solar and wind power plants usually operate with grid-following inverters, devices which synchronize with the grid’s existing frequency and voltage but cannot support grid stability (Bajo-Buenestado 2025).

Thus, European energy security is complex and there are no easy solutions. There are various threats to the EU’s energy security. In this paper we have defined four categories: (1) Geopolitical and adversarial threats including state coercion, weaponized dependence and cyberattacks; (2) Infrastructure and systemic vulnerabilities in energy networks and supply chains; (3) Resource scarcity and volatile markets for fuels and critical minerals; and (4) Political and regulatory challenges in governance and investment. This analysis examines each category in turn, outlining the threats and implications.

- Geopolitical threats and the weaponization of energy

Russia’s full-scale invasion of Ukraine not only marked the return of war to the European continent, but also exposed the EU’s dependency on gas and oil supplies. Russia’s attack on Ukraine, the war between Israel and Iran as well as the civil war in Yemen are a few examples of the impact of geopolitics on Europe’s energy supplies. While wars may have indirect effects on energy production and supply chains, rather often energy itself is also used as a weapon. This is especially evident in Russia’s actions following the invasion of Ukraine in 2022, when the Kremlin leveraged Europe’s dependence on Russian fossil fuels to exert political pressure, repeatedly throttling gas flows to EU countries in retaliation for their support of Ukraine (European Commission 2024; Vecchio 2024). In 2021, Russian supplies accounted for approximately half of the EU’s gas imports. In some member states, such as Germany and Austria, dependence was particularly high. Austria, for instance, sourced around 80% of its gas from Russia in 2021 (Pichler 2024).

By fall 2022, Russian Gazprom had halted deliveries to several states and pipeline shipments plummeted, driving European gas prices to record highs and forcing emergency rationing plans (Vecchio 2024). This revealed how Europe’s overreliance on cheap Russian gas, a risk long underestimated, became a strategic liability. Beyond economic coercion, direct and coveted (so-called “hybrid”) attacks on energy infrastructure have underscored the vulnerability of energy security. In September 2022, the sabotage of the Nord Stream Pipeline instantly hampered a major energy supply route (Ribeiro 2023). Ever since, state-sponsored and/or criminal actors have increasingly targeted digital energy systems, including grid control software and SCADA infrastructure, posing high-impact, low-visibility threats (Oliver 2024). Dozens of cyberattacks on EU energy infrastructure have been registered since 2022 the beginning of Russia’s full-scale war on Ukraine (Clark 2024).

Austria may hold a special position in this regard. As one of a few EU member states that is not part of NATO, Austria may be an enticing target country for covert attacks to put pressure on EU energy infrastructure without triggering a NATO article 5 response. A comparable example for this dynamic could be the 2019 Gulf of Oman incident, where a total of four oil tankers – two Saudi-flagged, one UAE-flagged and one Norwegian-flagged – were attacked by limpet mines in the Emirati port of Fujairah (Altaher & Westcott 2019). Following this incident, analysts have speculated that the Norwegian tanker was targeted specifically to send a message to Europe about the consequences of the American withdrawal from the Iranian nuclear deal, without directly impeding Iran’s relationship with the EU.

Energy disruptions due to geopolitical tensions, conflicts and wars therefore remains a relevant risk, particularly given the political volatility in other energy producing regions such as North Africa and the Middle East (Gitelman et al. 2023). As Europe advances on its decarbonization agenda, new dependencies form around the production of renewable energy technologies – China dominates solar panel supply chains, it controls 80% of the market (IEA 2021a) – as well as relevant critical minerals, many of which are concentrated in geopolitically sensitive regions with low supplier diversity (IEA 2021).

- Infrastructure and systemic vulnerabilities

Energy supplies depend as much on resources as on infrastructure and Europe’s energy infrastructural networks are aging. For example, most of the continent’s electricity grids are decades old and is facing challenges in bearing the current energy loads and they are hardly prepared for the feed-in of increasing shares of renewable energy. In addition to aging grid infrastructure, bottlenecks in cross-border interconnectivity and limited storage capacity render many national systems ill-prepared for the variable nature of wind and solar power (IEA 2021). The required up-scale in battery storage alone – projected from under 20 GW in 2020 to over 3000 GW by 2050 – reveals the massive investment and coordination gaps (IEA 2021). Strategic reserves and backup systems are insufficiently developed in many member states, particularly in Eastern and Southeastern Europe.

But risks are not limited to certain technologies. In 2022, France’s nuclear power supply suffered an unprecedented wave of outages caused by maintenance backlogs and age-related degradation. At one point, 26 of the country’s 56 reactors were offline, abruptly transforming France into a net electricity importer—exposing the acute vulnerability created by insufficient maintenance planning and investment (Crellin et al. 2022).

Additionally, insider threats and inadequate physical security remain under-addressed risks (Oliver 2024). Even though the EU initiated several projects to increase physical security and surveillance after Russia’s full-scale invasion of Ukraine (Reuters 2023), the scope of the problem is too big to solve in a whim. It will require long-term commitment, public investment and continued cross-border cooperation – also with actors outside of the Union.

Moreover, climate change poses a rising threat to energy infrastructure across Europe. Already, an estimated 25% of electricity networks are at high risk from cyclones, while over 10% are vulnerable to severe flooding (IEA 2021). Heatwaves, droughts and wildfires – increasingly frequent across southern and central Europe – degrade the performance of thermal plants, disrupt hydropower production and strain grid operations. These environmental pressures, compounded by aging infrastructure and limited resilience planning, elevate the risks of cascading failures.

Climate change also alters energy demand patterns. Heatwaves drive up electricity demand at the same time as they potentially reduce generation efficiency, especially within hydropower generation and nuclear reactors – as seen in France in 2022 (Crellin et al. 2022). Similarly, severe cold snaps send gas and power demand soaring, while infrastructure may face cold-related problems. Climate change not only transforms energy demand patterns but also infrastructure survivability (Gitelman et al. 2023) Therefore, it is critical to invest in disaster-resilient infrastructure standards and networks to mitigate these threats, as climate change-related disasters increase in frequency.

- Resource scarcity and market risks

The current shift away from diplomacy towards power politics has also laid bare the potential impact of resource scarcity issues and market instabilities as a threat to European energy security. The transition to renewables has not eliminated reliance on fossil fuels or global markets, rather, it has added the strategic risk to critical minerals and investment insecurities. Batteries for electric vehicles, solar panels, and wind turbines require materials like lithium, cobalt, nickel and rare earth elements that are concentrated in only a few countries. European energy transition plans largely depend on the supply of these rare earth elements. For instance China provides 100 % of the EU’s supply of heavy rare earth elements (REE), Turkey controls 99% of the EU’s supply of boron, and South Africa provides 71% of the EU’s needs for platinum (European Commission n.d.).

Furthermore, rapid technological developments create uncertainties for markets and investment. Investment mismatches and misaligned funding can leave Europe exposed to shortfalls in both traditional and emerging energy sources. Although oil demand is expected to fall in a net-zero scenario, a failure to coordinate investment across the European Union could result in undersupply shocks, driving up costs and reducing reliability (IEA 2021). Strategic stockpiles, market stabilization tools and diversified trade agreements are essential to buffer against short-term volatility and long-term scarcity.

- Political and bureaucratic challenges

A fragmented regulatory landscape continues to obstruct cohesive European energy policy. Members of the European Union diverge significantly in energy strategy, particularly regarding nuclear power, fossil fuel phase-outs and renewable subsidies. This regulatory incoherence impairs cross-border energy flows, investment efficiency, and crisis response coordination. The rapid pace of technological and market change – especially in renewables and hydrogen – is outstripping the ability of institutions to adapt frameworks and incentives accordingly (Gitelman et al. 2023). Moreover, slow permittance processes and local opposition delay infrastructure projects essential for security and decarbonization.

This challenge may be exacerbated by growing nationalist and isolationist tendencies within EU member countries. In case of increased political / nationalist competition and divergence within the EU necessary cross-border initiatives might not materialize.

The state of preparedness for European energy security

The European Union faces a complex set of challenges as it seeks to balance energy security with the urgent need for a low-carbon transition. In response to heightened geopolitical risks, particularly following Russia’s 2022 invasion of Ukraine, the EU has on the one hand tried to diversify energy supplies and its energy mix. On the other hand it has intensified efforts to safeguard critical infrastructure through enhanced cybersecurity, cross-border energy cooperation, and significant investments in resilient systems. This contains the provision requiring member states to adopt national strategies and carry out regular risk assessments (European Commission, September 23, 2024). However, achieving a secure, affordable, and sustainable energy supply while accelerating decarbonization remains a multifaceted endeavor, requiring careful coordination of policy, investment, and technological innovation.

Central to the EU’s strategy is the REPowerEU plan, launched in March 2022, which set out to drastically reduce reliance on Russian fossil fuels and catalyze the shift toward clean energy (European Commission, 2022). The plan’s ambitious targets include reducing fossil gas use by at least 155 billion cubic meters, the amount imported from Russia in 2021, and raising the share of renewables in the EU energy mix to 45% by 2030. This initiative is underpinned by a mix of regulatory reforms, infrastructure investments, and incentives aimed at boosting energy efficiency, expanding renewable energy capacity, and fostering the development of hydrogen and biomethane markets. The REPowerEU plan’s main objectives are multifaceted: phasing out Russian gas, oil, and coal imports by diversifying supply sources and routes; developing a robust EU hydrogen market, particularly through major corridors in the Mediterranean and North Sea; and increasing renewable energy deployment, with a target of 600 GW of solar photovoltaic capacity by 2030 (European Commission, 2022, 6). The plan also aims to double heat pump deployment rates, scale up biomethane production to 35 billion cubic meters by 2030, and promote behavioral changes to reduce gas and oil consumption by 5% (European Commission, 2022, 8). These measures are supported by an estimated €210 billion in investments between 2022 and 2027, with anticipated annual savings of €100 billion from reduced fossil fuel imports (European Commission, 2022, 12).

Diversification of the energy mix

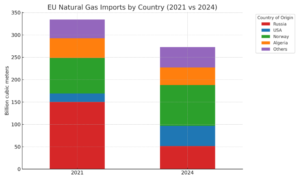

A cornerstone of the EU’s evolving energy security strategy is diversification and the reduction of the share of fossils in the energy mix. Gas import data suggests that the EU’s diversification efforts have been partially successful. Comparing 2021 to 2024 Russia’s share in EU gas imports plummeted from 44.9% to 18.9%[1] (European Council 2025).

Figure 2. Source: European Council

From 2022, Norway has emerged as the EU’s new top supplier (33.4%), reinforcing its role as a stable energy partner. Meanwhile, the U.S. has more than tripled its share (5.7% to 16.5%), capitalizing on LNG exports to fill the gap left by Russia. Algeria maintained steady influence (13.2% to 14.4%), while smaller suppliers ("Others"), such as Qatar and Azerbaijan, grew slightly, highlighting the EU’s broader push to reduce dependency on any single source.

Parallel to the diversification of supply, gas consumption in the EU dropped since 2021, by 19% (Eurostat 2025). The significant decline in gas consumption can be attributed to a range of factors. In addition to sanctions and Russia’s disruption of energy supplies, shifts in the energy mix, fluctuations in economic activity, weather conditions, behavioral changes, and the implementation of gas saving measures played a role (Zeniewski et al. 2023).

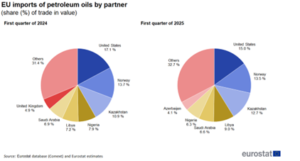

Similarly, imports of oil have diversified. While in 2021, Russia still accounted for about a quarter of oil imported into the EU, Russia’s share in oil imports fell significantly. Europe’s most important supplier are the United States, Norway, Kazakhstan, Libya, Nigeria and Saudi Arabia (Eurostat 2025).

This diversification has been complemented by accelerated investments in renewable energy, with wind and solar energy sources surpassing gas in electricity production in several member states. Preliminary data for 2024 also indicate that the EU has reached a new milestone in electricity generation, with renewable sources contributing a record 1,313 Terawatt hours (TWh). At the same time, electricity generated from fossil fuels dropped to an all-time low of 810 TWh. The share of renewable energy in the EU’s electricity mix has risen between 2023 and 2024 from 44.9% to 47.3%. This represents an increase of 2.4% in 12 months. Parallel to the increase in renewable energy the share of fossil fuels declined from 32.2% to 29.2%. Nuclear energy have up the remaining 23.4% (649 TWh), continuing its rebound from the historically low levels seen in 2022 (European Commission 2025).

In addition, there is a strong focus on new energy sources, particularly green hydrogen. While Europe has the potential to produce green hydrogen domestically — using water and renewable electricity — scaling up production would require substantial investments in wind and solar infrastructure. Thus, the EU is also pursuing import partnerships — for example, with North Africa and the Middle East — to diversify and supplement its energy supply. For storage and transport, hydrogen can be converted into ammonia, facilitating long-term reserves and emulating natural gas logistics, but without the associated carbon emissions.

Policy frameworks like REPowerEU and the European Hydrogen Alliance aim to accelerate market readiness, targeting 20 million tonnes of annual renewable hydrogen use by 2030 (half imported, half domestic) (European Commission n.d (b)). The EU estimates that this could substitute 27 billion cubic metres (bcm) of natural gas (roughly equivalent to 10% of 2024s total natural gas imports), 4.7 bcm of imported oil, and 156 kT of coking coal imports (European Commission November 16, 2022).

Despite these ambitious targets, significant challenges remain in implementation. The EU has set a goal of installing 40 gigawatts of electrolysis capacity by 2030, but it is unlikely to meet this objective. The supply chains and processing of strategic minerals needed for this technology are dominated by China, creating new dependencies unless changes are made. Moreover, the price competitiveness of green hydrogen remains questionable in the near future, mostly due to cheaper competitor products such as blue hydrogen, LNG and the expanding electrification of sectors that have so far relied on fossil fuels. Blue hydrogen is produced from natural gas (LNG or pipeline gas) and CO₂ is captured and stored (CCS) to reduce emissions (typically 50–90% capture rate) in the process. For the coming decade, an oversupply of LNG is expected, hence also pressuring the price of blue hydrogen (EWI 2025).

While the EU’s Hydrogen Strategy prioritizes green hydrogen (from renewables) but allows transitional blue hydrogen (with strict CCS requirements) to bridge gaps, the REPowerEU Plan specifically excludes blue hydrogen from subsidies, focusing solely on green hydrogen.

Furthermore, rapidly refitting gas infrastructure in Europe to allow for increased hydrogen use will remain a challenge. Nonetheless, hydrogen (whether blue or green) is all but certain to play a significant role in Europe’s energy mix in the near future.

Currently, the Gulf states are investing heavily in hydrogen technologies and are emerging as potential key partners for Europe in the transition to clean energy. While Brussels has signed a green hydrogen Memorandum of Understanding (MoU) with the UAE, and several European countries have established bilateral agreements with GCC states, a comprehensive EU-GCC hydrogen partnership has yet to materialize. Progress is hindered by disputes over carbon accounting methodologies and rules regarding the sourcing of renewable energy.

While all these efforts aim to reduce vulnerability to geopolitical shocks and support the EU’s broader climate objectives, it is essential to avoid creating new dependencies.

Infrastructure

The reduction of vulnerabilities and transition to a low-carbon energy system also necessitates substantial upgrades to Europe’s energy infrastructure. The EU has prioritized enhancing cross-border transmission networks, streamlining permitting for renewable projects, and developing facilities for sustainable biomethane and hydrogen production. Addressing bottlenecks in energy transmission and supporting zero-emission transport infrastructure are integral to ensuring a secure and flexible energy supply. Moreover, integrating these reforms into national recovery and resilience plans ensures a coordinated, EU-wide approach to energy independence and sustainability. Cybersecurity has emerged as a critical pillar in the EU’s energy strategy, given the increasing digitization and interdependence of energy systems.

The introduction of the NIS 2 Directive, the Cyber Resilience Act, and sector-specific network codes reflects a comprehensive regulatory response to rising cyber threats, which have doubled in recent years. In addition, the European Commission issued in March 2025 the EU Preparedness Union Strategy which aims to implement a whole-of-society approach and whole- of-government approach and improve the anticipation of events and fine tune coordination among member states in case of an event (European Commission 2025). All these frameworks mandate stronger risk management, improved incident reporting, and enhanced coordination among member states. However, challenges persist, including disparities in national capabilities and investment levels, as well as a significant shortage of skilled cybersecurity professionals. Addressing these gaps through increased investment, workforce development, and cross-border collaboration will be essential to maintaining the resilience and security of Europe’s energy infrastructure as the transition to a low-carbon economy accelerates.

Conclusion

Energy security exists on a spectrum, influenced by a range of geopolitical, economic, and technological factors that shape a nation’s ability to ensure a stable and reliable energy supply. While the concept of energy independence and energy autarky (meaning complete energy self-sufficiency) are often discussed, it is widely recognized in academic and policy circles that absolute independence is unattainable due to the interconnectedness of global energy markets. Instead, energy security should focus on enhancing preparedness and resilience to minimize vulnerabilities to supply disruptions or targeted attacks on energy infrastructure. What is needed is a shift away from sectoral and nation-state-based thinking toward a more holistic, union-wide systemic approach—one that acknowledges Europe’s structures, strengths, differences and vulnerabilities, and develops resilience strategies capable of addressing the complex interplay of crises in our interconnected world.

Diversification has appeared to be a cornerstone of energy security, encompassing both geopolitical and supply dimensions. Geopolitical diversification involves sourcing energy from a variety of international partners to reduce dependence on any single country or region, thereby mitigating the risks associated with political instability or diplomatic disputes. Supply diversification, on the other hand, refers to the use of multiple energy sources, such as renewables, nuclear, and fossil fuels, to create a balanced and flexible energy mix that can adapt to changing circumstances.

Spain and Portugal on the one hand provide instructive examples: Both countries have invested heavily in renewable energy, particularly wind and solar, reducing their reliance on imported fossil fuels and increasing their resilience to external shocks. At the same time, the blackout on the Iberian Peninsula in April 2025, highlighted the need to address infrastructural and technological issues for a larger share of renewable energy.

Austria, while possessing significant hydropower resources, remains vulnerable due to its dependence on natural gas imports, particularly from Russia. By emulating the Iberian approach, expanding renewables, fostering regional cooperation, and diversifying supply routes, Austria can strengthen its energy security posture.

Ensuring the resilience of energy systems requires not only the establishment and maintenance of robust infrastructure but also the preparation of society at large. Investments in grid modernization, storage technologies, and cross-border interconnections can enhance the flexibility and reliability of energy supply. Equally important is raising public awareness about energy conservation and emergency preparedness, as an informed and engaged populace is better equipped to respond to disruptions and support national resilience efforts.

Political unity within and among member states is crucial for advancing energy security objectives, particularly in the face of shared threats and opportunities. Decentralization of energy production, through local or individual initiatives such as rooftop solar panels and community wind projects, can further bolster resilience by reducing reliance on centralized systems and enabling rapid adaptation to local conditions.

[1] The decrease in Russian gas imports was less the result of EU sanctions – the EU did not impose sanctions on gas imports – but rather the result of Russia’s retaliation to EU sanctions with restrictions on gas exports to the EU (Keliauskaité 2025, Reininger & Virokannas 2024).

Downloads